News & Media

Protecting America’s Energy Security in an Era of Energy Transition

March 29, 2023

By Bob Martin, Managing Director at Christie 55 Solutions

As the United States and the globe work toward a net-zero carbon target by 2050, America’s energy transition needs to have an effective and realistic plan that includes a balanced energy mix that actively manages risks. Managing these risks is critical to the US protecting its energy security over the next several decades, especially by maximizing the abundance of energy resources at our disposal.

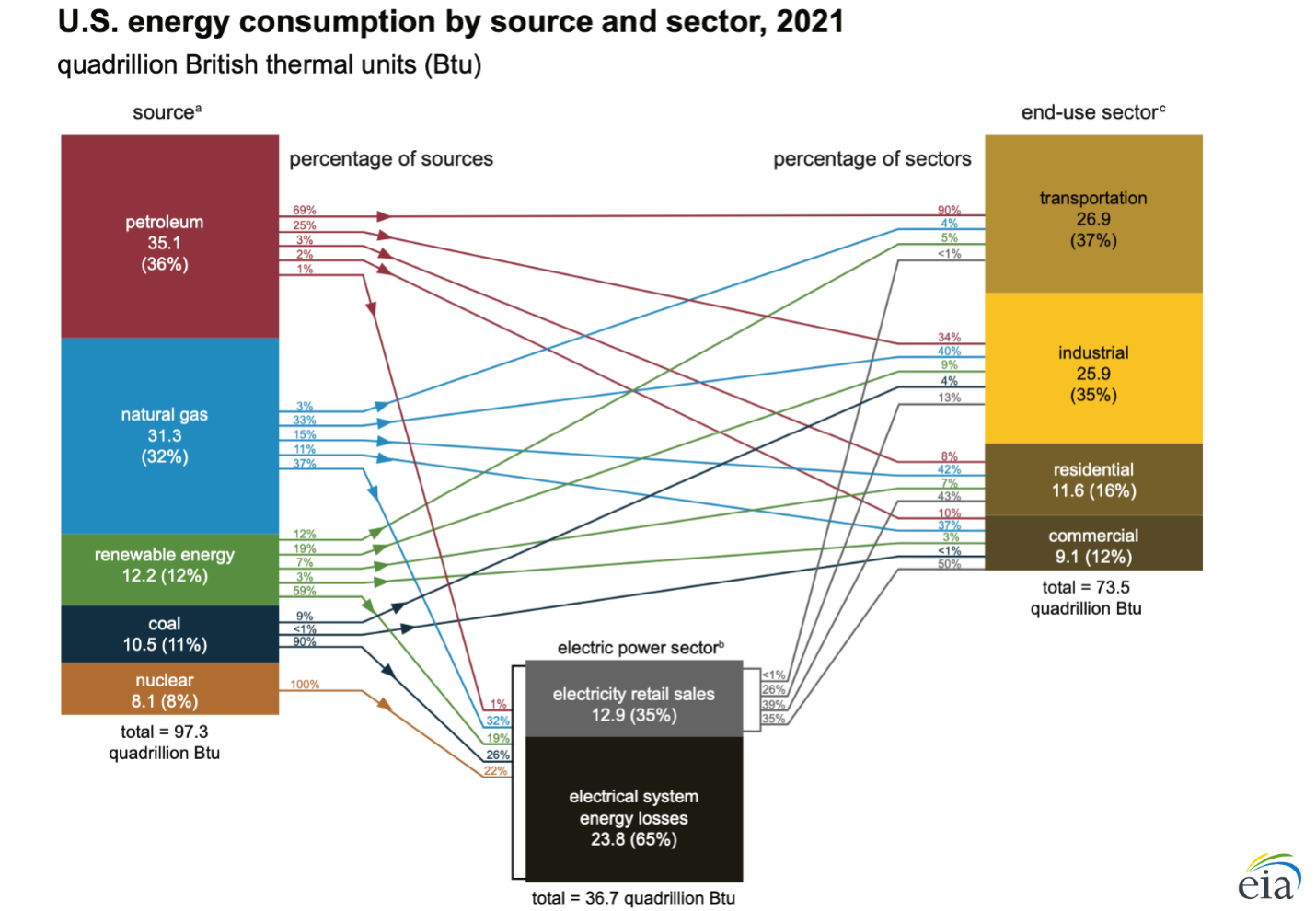

A balanced portfolio of energy across all consumption sectors, which includes the electric power sector and the end-user transportation, industrial, residential, and commercial sectors is necessary to protect reliability, resiliency, and price volatility.

World events, especially the Russian invasion of Ukraine, highlight the fragile nature of the global energy market and underscores the false sense of security we have about the availability and cost of energy. Even before the Russian invasion of Ukraine, “the energy market and supply imbalances of 2021 were carried over to 2022 with energy pricing sustaining record-high levels,” according to the World Economic Forum’s “Fostering Effective Energy Transition, 2022 Edition” (Insight Report May 2022). This volatility was reflected in unprecedented spikes in oil and natural gas prices. It also highlights the need to have an adequate abundance of a diversified mix of energy sources during an energy transition period.

These spikes in energy costs have fueled inflation and hit consumers’ pocketbooks directly in high gasoline, heating oil, and natural gas prices, and pushing up the product costs because of increased transportation and manufacturing costs.

Most concerningly, recent geopolitical events exposed US energy vulnerability on supply and cost and our inability to control factors outside our borders. This vulnerability goes to the heart of energy security for the country, which is critical to US national security.

Energy Security

The International Energy Agency (IEA) defines energy security as the “uninterrupted availability of energy sources at an affordable price.” They go on to state that energy security has many aspects, including “long-term energy security mainly deals with timely investments to supply energy in line with economic developments and environmental needs . . . and short-term energy security focuses on the ability of the energy system to react promptly to sudden changes in the supply-demand balance.”

US access and availability of energy resources is vast, including oil, natural gas, wind, solar and nuclear power. This access and availability of energy resources provides the US with an enviable position of energy independence, which is a critical element of energy security. While energy independence doesn’t guarantee energy security, because of the global nature of commodities like oil, it does protect against commodity shortages.

The pace of the energy transition in the US must continue to move forward rapidly. While we should not slow down, we must, at the same time, clearly understand the risks and how to best manage those risks. It is crucial to manage reliability, resiliency, cost, energy security, and national security.

The energy transition aspects of a comprehensive US energy plan must manage the risks around energy security, reliability, resiliency, costs, and infrastructure. This transition must balance the fuel mix needed, including fossils fuels, over numerous decades to manage those risks. The transition to renewables in the long run will help moderate the volatility of fossil fuel markets in the US and globally.

America’s Energy Today

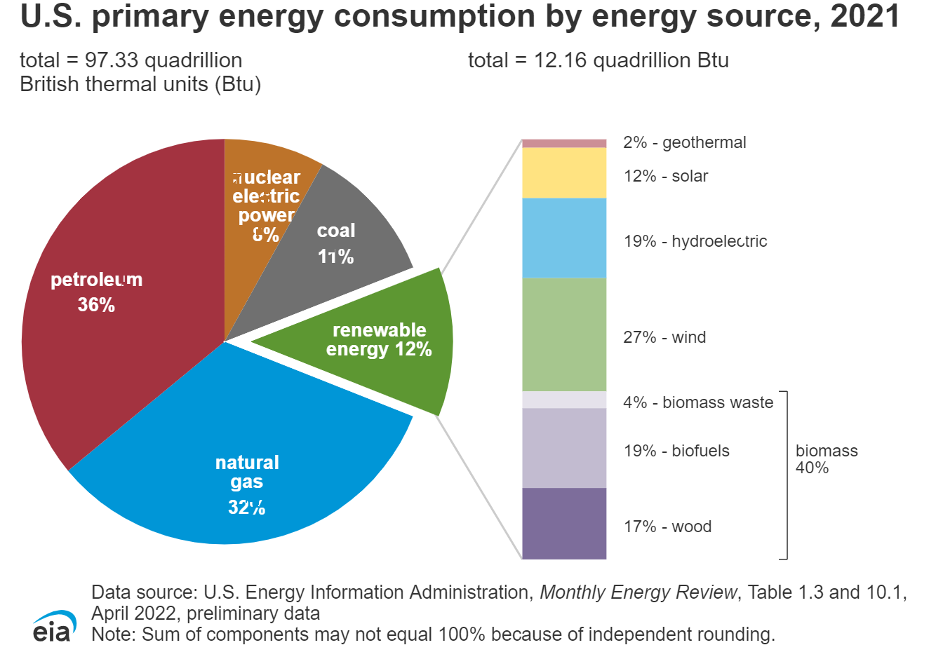

While recent and dramatic growth in renewables has occurred, the reality is that about 79% of the energy Americans consume today are fossil-based. DOE’s Energy Information Administration data for 2021 showed that about 36% of the energy consumed in 2021 was petroleum, natural gas was consumed at 32%, and coal made up at 11%. Renewables make up only about 12% of the energy consumed in the US. Nuclear makes up the final 8%.

This consumption crosses all sectors, including electricity generation, transportation, industrial, residential, and commercial. The vast majority (69%) of petroleum is consumed by the transportation sector, while a majority (59%) of the energy generated from renewables goes to the electric generation sector. Natural gas feeds into all consumption sectors, with most of it consumed by the industrial and electric power sectors for a total of 70%.

America’s Energy Needs through 2050 and Beyond

The challenge for the US is that the demand and consumption of petroleum and natural gas will continue to grow through 2050 and beyond.

The EIA projects that “petroleum and natural gas remain the most-consumed sources of energy in the United States through 2050, but renewable energy is the fastest growing.” They “project that U.S. energy consumption will continue to grow through 2050 as population and economic growth outpace energy efficiency gains. Petroleum and other liquids will remain the most-consumed category of fuels through 2050.” At the same time, IEA states that the “production of renewable energy will grow more quickly than any other fuel source through 2050.”

But there remains good news for renewables. IEA’s assessment is that “the share of generation from renewable energy sources, such as wind and solar, will rapidly increase over the next 30 years as state and federal policies continue to provide significant incentive to invest in renewable resources for electricity generation and transportation fuels." They also state that “new technologies will continue to drive down the cost of wind and solar generators, further increasing their competitiveness in the electricity market.”

In EIA’s “Annual Energy Outlook 2022,” the agency “project[s] that the share of U.S. power generation from renewables will increase from 21% in 2021 to 44% in 2050. This increase in renewable energy mainly consists of new wind and solar power.” The agency goes on to say that for wind and solar, “the declining costs for both technologies play a significant role in both near- and long-term growth.”

As for fossil fuels in electricity generation, EIA projects that over the next 27 years, “the total share of U.S. fossil fuel-fired power generation decreases from 60% to 44% . . . as a result of the continued retirement of coal generators and slow growth in natural gas-fired generation.”

One critical factor EIA identifies is that while “the share of natural gas in the total generation mix decreases slightly, from 37% in 2021 to 34% in 2050 . . . natural gas-fired generation increases in absolute terms.” That is an important factor as we look to certain resources, like natural gas, and the need to ensure that supply remains as a critical supply in our energy portfolio between now and 2025, and well beyond. Renewables and natural gas will be critical to support an electrification strategy in the US over the next several decades.

Managing Energy Security Risks

Given the data and projections by the US Department of Energy, there are four key risks the US must manage through for the next several decades to ensure America’s energy security. These risks include:

- Ignoring the realities of America’s energy needs for the next several decades will jeopardize US energy security.

- Inadequate planning and investment in US energy infrastructure will hinder renewable growth and a strong energy portfolio.

- Ignoring the affordability of energy may unintentionally stall the transition to renewables.

- Ignoring the need for long-term planning for supply chains and critical minerals for renewables could dramatically slow their rate of growth.

Let’s discuss each of these risks below.

Ignoring the realities of America’s energy needs for the next several decades will jeopardize US energy security.

While renewable energy continues to grow at an accelerated pace, especially for electricity generation, the US needs to face the stark reality that the US consumption of petroleum and natural gas will continue to be the dominant sources of energy consumed in the US well beyond 2050. Based on these projections by EIA, it’s obvious that US investment in all energy resources is imperative to protect our energy security, economic growth, and national security interests.

The energy needs of all the sectors of the US energy economy, including The energy needs of all the sectors of the US energy economy, including electric power sector and the end-user sectors of transportation, industrial, and residential, and must be addressed.

To minimize this risk, the US must commit to:

- Continuing to invest heavily in renewable energy. This is the long-term term plan for energy security. This goes to the heart of the IEA’s definition of a long-term energy security with the US making “timely investments to supply energy in line with economic developments and environmental needs.”

- Recommitting investments and efforts in fossil fuels, especially petroleum and natural gas, for the next several decades. This aligns with IEA’ definition of a short-term energy security focus with the US having the energy resources necessary “to react promptly to sudden changes in the supply-demand balance.” To be precise, this means providing investments, permitting and certain public lands for oil, natural gas and shale exploration, drilling, and pipelines necessary to carry the US well beyond 2050.

- Reducing the US (and global) carbon footprint in electricity generation by making significant investments in proven carbon-free sustainable nuclear power. The dawn of new technologies in this space, especially Small Modular Reactors (SMR), will make the implementation of nuclear faster, cheaper, and even lower risk.

- Investments in new technologies that accelerate bringing technologies such as green hydrogen and renewable natural gas to market faster and at lower costs.

The World Economic Forum’s “Fostering Effective Energy Transition, 2022 Edition” (Insight Report May 2022) describes risk mitigation well.” As the transition remakes the energy system, energy security concerns also require upfront risk mitigation measures. Investments in contingency measures, such as strategic reserves for petroleum and storage infrastructure for natural gas, can reduce the impact of disruptions in supply of these fuels.”

Other key aspects of ensuring America’s energy security are the long past due changes needed to the US laws and regulations that hinder both renewable and fossil growth and predictability. Key changes need to be made in the National Environmental Policy Act (NEPA) and in the Federal Energy Regulatory Commission’s regulations.

Inadequate planning and investment in US energy infrastructure will hinder renewable growth and a strong energy portfolio.

There is significant discussion in the US about the sources of energy and the reduction of carbon emissions, but little attention is spent on the necessary key infrastructure requirements to deliver renewable energy and to strengthen US energy security. Critical infrastructure, such as the electric grid and pipelines for oil and natural gas, are a major part of energy security and will require significant investments over the next several decades.

The electric infrastructure, as inventoried by Edison Electric Institute (EEI), includes more than 600,000 miles of backbone electric transmission lines, 240,000 of which are high-voltage lines (230 KV or greater).

The reliability of the electric transmission grid is challenged by outdated grid architecture from the 1950s and 60s and the overall age of the network. This will pressure operators to keep up with necessary upgrades. The Department of Energy (DOE) reports that 70% of transmission lines and large power transformers are more than 25 years old and that the average age of all the installed infrastructure is about 40 years old.

Resiliency of the grid is essential given climate change, warming oceans, wildfires, and more severe weather events. The challenges in California from both an aging transmission network and more prevalent wildfires, as well the Texas “deep freeze” in February 2021 and inadequate planning by grid operator ERCOT, demonstrate just some of the current and future resiliency planning needs that must be addressed.

Even though reliability, resiliency, and efficiency are critical driving factors for modernizing the grid, the most dominant single factor is now renewable energy. The current electric grid has limited capabilities to handle the US renewable energy future.

According to a 2020 Princeton University study, “Net-Zero America,” “to achieve a zero-carbon future by 2050, the existing high voltage transmission capacity will need to expand by approximately 60 percent by 2030 and triple compared to 2020 capacity through 2050 to connect wind and solar. Total capital investment in transmission will need to reach $360 billion through 2030 and $2.4 trillion by 2050.”

At the same time, the pushback on growth in oil and natural gas pipelines in the US, both at the federal level and in several states, is short-sighted. There needs to be a realistic and effective plan to maintain and expand these assets for reliability, redundancy, and energy security.

Ignoring the affordability of energy may unintentionally stall the transition to renewables.

A key component to ensure a stable energy transition to renewables and a net-zero economy by 2050 is the need for a transparent discussion with the American people about the realistic investment that is needed and who will pay that cost. The general lack of transparency around these costs at both the federal and state levels of government create suspicion and uncertainty that may, over time, stall the transition. Unrealistic targets not tied to costs and implementation plans diminish the credibility of transition efforts.

Over time the obvious challenge will be the impact on consumers, including industrial and commercial sectors, but more importantly individuals. Affordability needs to be addressed. The World Economic Forum’s “Fostering Effective Energy Transition, 2022 Edition” (Insight Report May 2022) makes the observation that “steady energy affordability is essential for economic growth and social justice, and both are key to keep energy transition momentum going.”

McKinsey & Company’s January 2022 Report, “The Net-Zero Transition,” estimates that, on a global basis, $2.7 trillion will continue to be spent on “high-emissions assets,” while $2 trillion will continue to be spent on “low-emissions assets,” and $1 trillion will need to be “reallocated from high- to low-emissions assets.” The report then states that there needs to be a $3.5 trillion “increase in spending on low-emissions assets vs. today.” This means that, of the $9.2 trillion annual capital spending on physical assets for energy and land-use systems globally, $6.5 trillion will be needed to reach a net-zero target by 2050. Obviously, this amounts to a significant investment by all countries between now and 2050.

There are several models and projections for the cost for the US to achieve net-zero by 2050. One of the best analyses comes from a 2020 report on “Carbon-Neutral Pathways for the United States” by AGU Advances. One of their key take-aways was that “the United States can reach zero net CO2 emissions from energy and industry in 2050 at a net cost of 0.2-1.2% of GDP, not counting climate benefits.” This translates to $1.7 – $2.4 trillion by 2050.

To manage this risk, the US must commit to an energy plan that includes:

- Realistic projections of net costs to the US economy and end consumers over the next several decades;

- Transparent and open discussions about these costs, and who will pay for them and how will they be paid for; and

- Ensuring that all investments find a balance between costs to consumers and the most efficient way to achieve net-zero goals.

Ignoring the need for long-term planning for supply chains and critical minerals for renewables could dramatically slow their rate of growth.

Renewable energy will require critical components, metals, and minerals to ensure that the rate of growth in renewables continues, and accelerates, over the next several decades. The World Economic Forum’s “Fostering Effective Energy Transition, 2022 Edition” (Insight Report May 2022) states “the transition to clean energy depends heavily on access to minerals, such as lithium, cobalt, nickel, copper, etc., to manufacture solar panels, wind turbines, and batteries”.

Access to these resources is complicated by the fact that they are concentrated in a very limited number of companies and countries. In many cases, these resources are concentrated in China. The World Economic Forum report goes on to state that, “while the demand of these minerals is expected to grow six-fold for a transition to net zero by 2050 according to the IEA, the production of transition minerals, such as cobalt, lithium, and graphite, is more concentrated than that of fossil fuels and gas.”

The global concentration of photovoltaic (PV) solar panels manufacturing also poses issues. The IEA states that the “Global solar PV manufacturing capacity has increasingly moved from Europe, Japan and the United States to China over the last decade.” The agency goes on to state that “China’s share in all the manufacturing stages of solar panels . . . exceeds 80%.”

Given the US’s need to grow solar, especially at utility-scale for the next several decades, this type of concentration jeopardizes US renewable goals.

To minimize this risk, the US needs to:

- Diversify the supply of all critical minerals;

- Diversify the manufacturing of critical components;

- Leverage US mining and manufacturing; and

- Leverage global allies and partners around the world.

Summary

The US needs to view our energy security as our national security. America’s energy transition needs to have an effective and realistic plan that includes a balanced energy mix and a plan that actively manages risks as the US works towards a net-zero carbon target by 2050. Renewables, such as wind and solar, and cutting carbon in all sectors are necessary. America’s ability to manage the risks around the transition will help to accelerate that transition. Managing these risks is critical to the US protecting its energy security over the next several decades, especially by maximizing the abundance of energy resources at our disposal.